In prior articles, we explained the economic benefits of controlling freeness in the stock refining operation. There are additional benefits beyond the economic considerations. Environmental-Social-Governance (ESG) considerations are a growing concern in today’s business environment. Solutions that reduce the emission of carbon dioxide are in high demand.

In stock refining, an objective is to ensure sufficient fiber development occurs so that fiber bonding yields desired strength properties at the reel. This can be achieved by preventing freeness from getting too high. When freeness is high, it is an indication of insufficient refining. While low freeness can cause drainage problems on the wire section of a paper machine, often the concern is to keep freeness below a limit to ensure sufficient fiber development.

(In the examples below, data is not from an industrial process. It is simulated data to demonstrate the principles with realistic assumptions)

Imagine we have a refiner on hardwood stock. We want to keep the freeness below 425 CSF. We have determined that a specific energy target of 1.2 HP-D/Ton achieves this goal. While this prevents freeness from exceeding 425 CSF, it also means that at times we are over-refining. This is because the incoming freeness can vary. When the incoming freeness is high, the 1.2 HP-D/Ton target brings freeness down to 425 CSF. However, 1.2 HP-D/Ton brings freeness well below 425 CSF when incoming freeness is low. The energy applied to reduce freeness below 425 CSF is unnecessary.

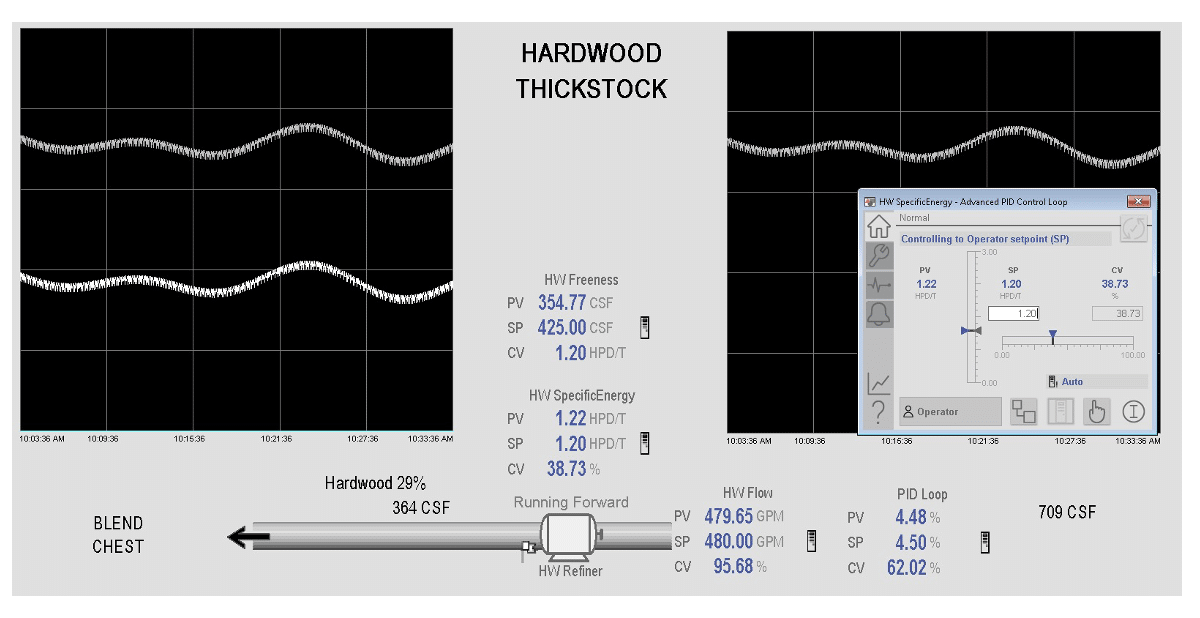

Illustrated below is the process simulation with specific energy in AUTO control and a setpoint of 1.2 HP-D/Ton. Notice that the incoming freeness on the right has variability passed on through specific energy control. Although specific energy reduces freeness from 709 CSF to 364 CSF, any freeness below 425 CSF represents wasted energy.

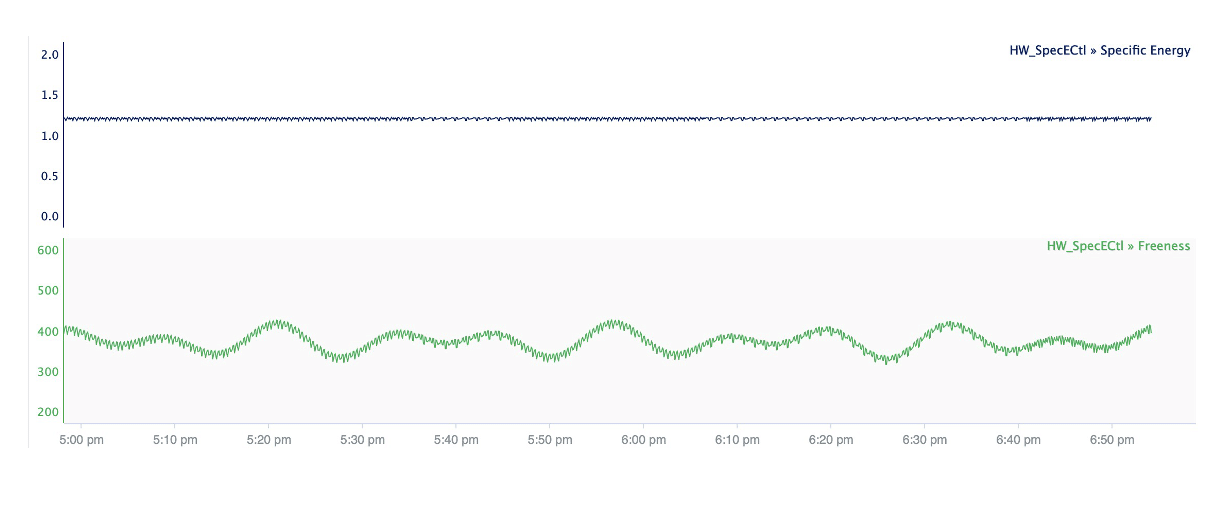

It looks like this when we analyze this historical data in a data analytics platform like Seeq. The specific energy is constant, but the outgoing freeness varies and often drops well below 425.

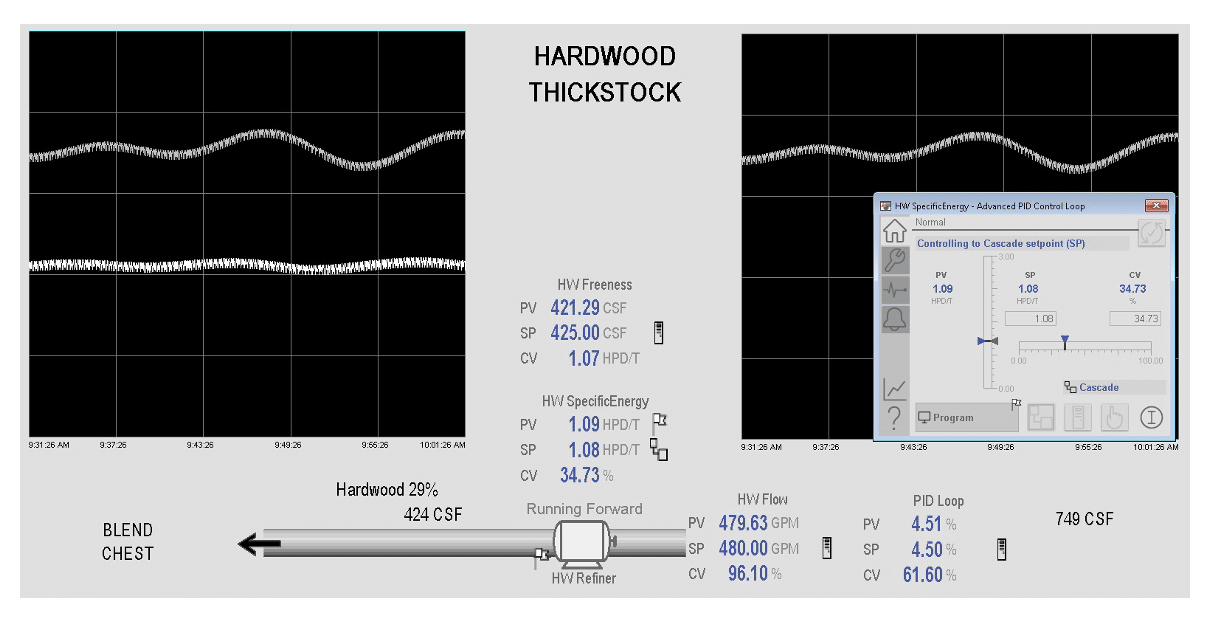

Now we compare what happens when we automate with freeness control. Below we see specific energy is in CASCADE mode. Freeness control sets the specific energy setpoint required to maintain 425 CSF, which in the case below is 1.08 HPD/T.

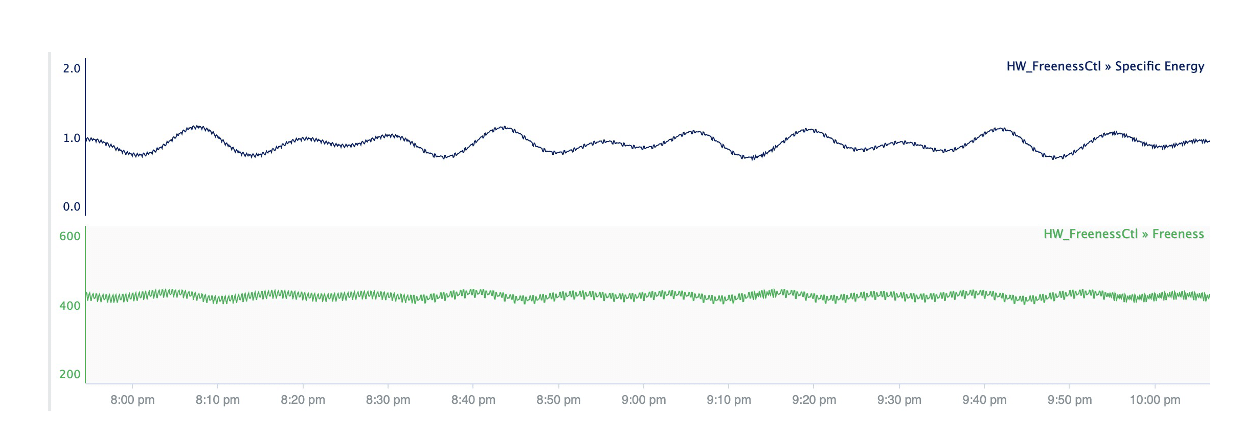

In Seeq we see that with specific energy control, we maintain a stable freeness at 425 CSF while the specific energy is often below 1.2 HPD/T.

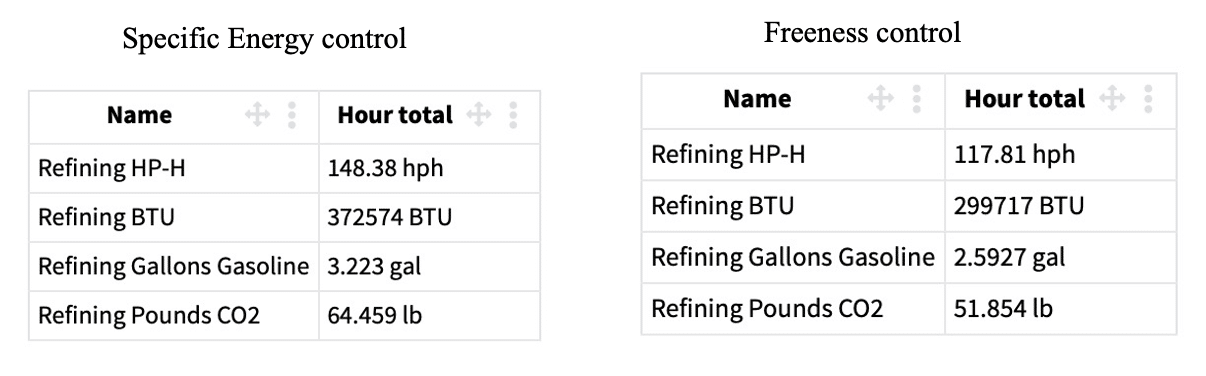

To determine how this impacts ESG goals, we can use Seeq to calculate these benefits. Seeq makes integrating the energy usage per hour in each case easy. Below is the comparison of energy usage in refining in each case, using 130 Tons per day of dry fiber through the refiner. Conversion factors are 2511 BTU per HP-Hour, 115,600 BTU per gallon of gasoline, and 20 pounds of CO2 produced per gallon of gasoline. Since it is very common for CO2 emission to be stated in terms of fossil fuels such as gasoline, we do this conversion from electrical energy to gallons of gasoline to compare the results in familiar terms.

We see that Freeness control yields the following ESG benefits:

- Reduction of 12.605 pounds CO2 per hour

- Reduction of 302 pounds CO2 per day

- Reduction of 105,882 pounds CO2 per 350 operating days per year

- Reduction of 53 tons CO2 per year

- The equivalent reduction of 5,294 gallons of gasoline per 350 operating days per year

Automation can yield many benefits. In comparison, the operational focus tends to be economic, in today’s business environment additional consideration become important. Let Pulmac help you achieve your economic and ESG goals.